Historical Examples of

Hyperinflation

by Kevin Wilson

$10,000,000 bills! $1,000 for a loaf of bread? Using money for toilet paper? Burning bills to heat the house? That's the crazy effects of hyperinflation, and it happens more often than you think.

According to Wikipedia the main cause of hyperinflation is a massive and rapid increase in the amount of money (including bank credit, deposits, and currency) that is not supported by a corresponding growth in the output of goods and services.

Typically a central bank (who controls the monetary system) will print extra money to stimulate the economy due to war, recession, etc. This results in too much money in the money supply. This causes prices to rise (inflation). If too much money is printed, prices will continue to rise and people will lose faith in the currency. Prices can begin to rise every day, prompting people to buy goods as fast as possible. The increased demand for goods causes further price increases. More money must be printed to keep up with quickly rising prices, creating a vicious circle that spirals out of control.

Usually the government implements price controls, but that only delays the destruction. Often, when denominations reach into the millions a new currency will be created that can be exchanged for some fraction of the previous domination ($1 new dollar = $10,000 dollars) but this is only a psychological benefit. Eventually a new, stable currency takes over, sometimes a neighboring country's currency.

There have been dozens of currencies that have been destroyed due to hyperinflation. This is a few of them:

Venezuela is currently (2018) experiencing hyperinflation. At this time the highest denomination is the 100,000 bolivares fuertes note.

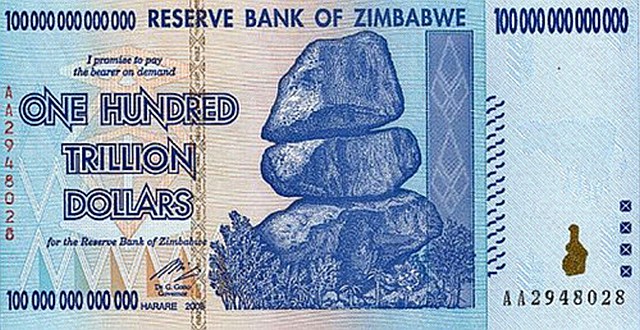

Hyperinflation in Zimbabwe began in the late 1990s and peaked around 2008 to 2009. It was one of the few instances that resulted in the abandonment of the local currency. At one point, prices were doubling every day.

Belarus experienced steady inflation from 1994 to 2002. The highest denomination was 5,000,000 rublei.

Georgia went through its worst inflation in 1994. By 1994, the highest denomination was 1,000,000 kupon lari.

Angola experienced hyperinflation from 1991 to 1995. The highest denomination was 500,000 kwanzas.

Romania experienced hyperinflation in the 1990s. In early 2005 the highest denomination was 1,000,000 lei.

Yugoslavia went through a period of hyperinflation and subsequent currency reforms from 1989 to 1994. The highest denomination was 500,000,000,000 dinars.

Here we see the great Nikola Tesla on the 10,000,000,000 dinars bill.

Nicaragua went through it's worst inflation from 1987 to 1990. The highest denomination in 1990 was 100,000,000 new cordobas.

Peru experienced its worst inflation from 1988 to 1990. The highest denomination was 5,000,000 intis by 1991.

Bolivia experienced its worst inflation between 1984 and 1986. By 1985, the highest denomination was 10 Million pesos bolivianos.

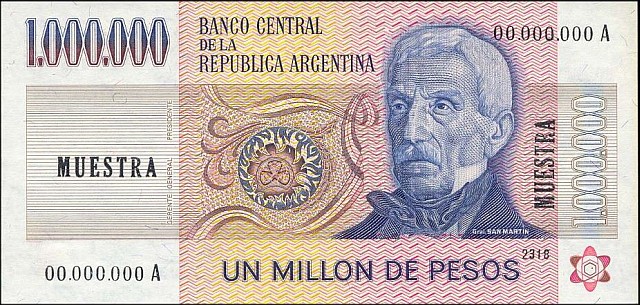

Argentina went through steady inflation from 1975 to 1991. The highest denomination was 1,000,000 pesos.

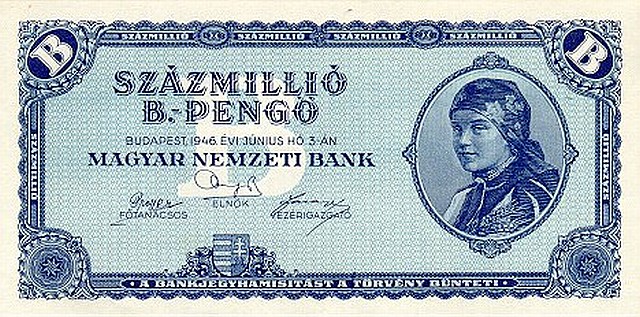

Hungary went through the worst inflation ever recorded between 1945 and 1946. The highest denomination in mid-1946 was 1,000,000,000,000,000,000,000 pengo. In 1946, 400,000,000,000,000,000,000,000,000,000 pengo became 1 forint. The 100 quintillion pengo is the largest denomination banknote ever officially issued for circulation. At one point, prices increased 200% every day.

Greece went through its worst inflation in 1944. By 1944, the highest denomination was 100,000,000,000 drachmai.

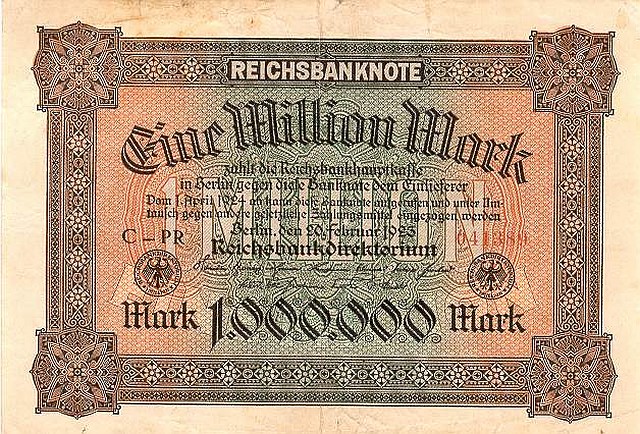

Germany went through its worst inflation in 1923. By 1923, the highest denomination was 100,000,000,000,000 Mark.

After Poland's independence in 1918, the country soon began experiencing extreme inflation. Poland experienced a second hyperinflation between 1989 and 1991. The highest denomination was 2,000,000 zlotych in 1992.

The United States experienced hyperinflation between 2020 and 2023 after excessive quantitative easing by the Federal Reserve Bank in a failed effort to end a prolonged recession (the government never acknowledged the recession existed). The central bank later claimed it had no choice but to carefully devalue the dollar, making it possible to reduce the massive national debt that resulted from bank bailouts and several unsuccessful wars - and to normalize exchange rates, making American industries more competitive with other countries.

In late 2022 a new dollar was issued at an exchange rate of $1 new dollars = $10 old dollars. The new dollar was backed by a partial gold standard with fixed exchange rate of $20,000 new dollars = 1oz gold.